The “CIO Playbook 2024 – It’s all about Smarter AI” report, a collaboration between Lenovo and IDC, finds 94% of CIOs in Asia-Pacific (APAC) – including the ASEAN+ region of Indonesia, Singapore, Thailand, Malaysia, Philippines, Hong Kong, and Taiwan – view AI as essential for competitive advantage in 2024. Despite this widespread recognition of AI’s importance, only 11% are investing in generative AI.

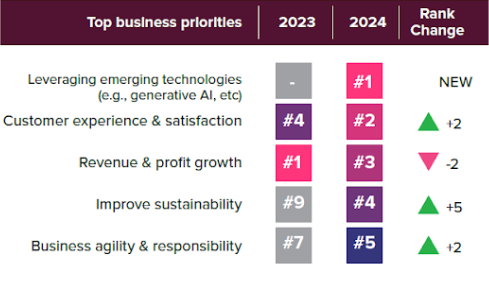

The study, surveying over 900 CIOs with more than 370 from ASEAN+, indicates APAC organisations are set to increase their AI budgets by 45% in 2024 compared to 2023. This shift suggests a move towards prioritising customer experience and satisfaction over the previously dominant goals of revenue and profit growth.

However, the report highlights a discrepancy in the approach towards AI technologies between business leaders and CIOs. Business leaders are keen on adopting generative AI to improve customer experiences and drive outcomes, whereas CIOs prefer a more cautious approach, placing generative AI as their third technology priority. Their focus remains on AI solutions that enhance security, infrastructure, and cyber resilience.

Kumar Mitra, MD & RGM – CAP, Lenovo ISG, stated, “The AI Playbook echoes what we have been hearing from the customers. CIOs across ASEAN+ are confident about AI, with 94% expressing that it will create a competitive advantage, and 51% of them consider it to be a game changer for their organisations. Higher investments in generative AI and machine learning, followed by deep learning systems, underscore their desire to improve operational efficiency, security, decision-making processes, and customer experiences.”

Key trends for ASEAN+ CIOs

CIOs from India (28%) and Korea (33%) lead generative AI investments in the Asia-Pacific, ahead of their counterparts in ASEAN+ (11%), ANZ (2%), and Japan (2%). The emphasis in ASEAN+ is on the infrastructure necessary to support applications, with security and intellectual property emerging as critical concerns for enterprises exploring generative AI.

Survey findings from ASEAN+ CIOs reveal:

| Generative AI investment (Invested + Planning) | Top 2 areas of interest | Recruitment difficulty for AI positions (Extreme + moderate) | Top 2 priorities in preparation for generative AI |

| (11% + 80%)91% | 1. Business intelligence 2. Productivity | 52% | 1. Networking infrastructure 2. Employee skill development |

- Adoption challenges: High dependence on third parties (40%), monitoring AI misuse/hallucinations (incorrect predictions) and security (38% each) are the top three concerns for CIOs in Singapore.

- Deployment challenges: Lack of requisite training in AI automation tools (57%) and job security (50%) are key pain points for CIOs in Singapore. This is true across ASEAN+ as well.

AI deployment preferences in APAC

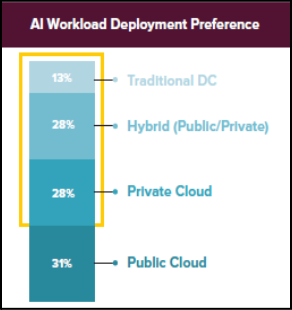

About 69% of APAC CIOs show a preference for managing AI workloads within non-public cloud environments. In Singapore, 68% of CIOs are already employing AI to strengthen their security frameworks, and an additional 25% are planning to make investments in this area.

The survey indicates APAC companies are adopting a balanced approach to AI workload deployment. Expected distribution includes 31% on public clouds, 28% on private clouds, and 28% on hybrid cloud solutions.

Scott Tease, Vice President of High Performance Computing & AI at Lenovo, highlighted the allocation of 13% of AI workloads to traditional data centres. This move underlines the growing importance of edge computing, aiming to bring AI capabilities closer to data sources.

At the same time, 68% of CIOs in Singapore are already using AI to enhance their security framework with 25% planning to invest.

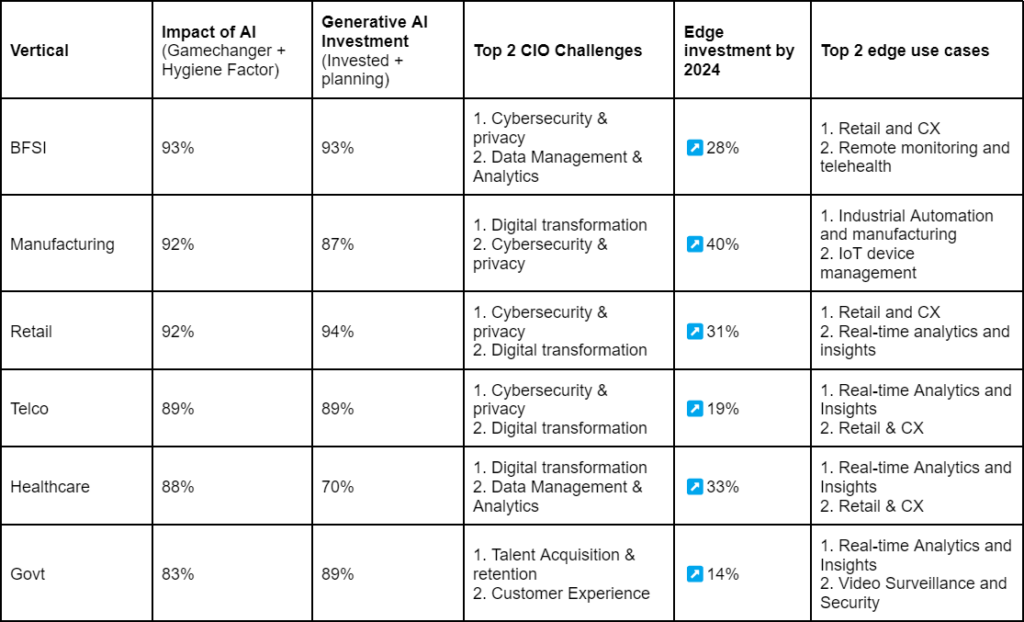

2024 trends for APAC CIOs across key industries

ASEAN+ insight

- The AI platform market in ASEAN+ is growing at approximately a 40% compound annual growth rate, with financial services, manufacturing, and government sectors leading in investment.

- Beyond traditional AI applications like fraud detection and quality inspection, there is significant growth in horizontal use cases such as search/knowledge management, cybersecurity, chatbots, and AI operations.

- Although Singapore is considered a mature market for AI, expanding AI initiatives to achieve substantial return on investment across multiple business areas remains challenging.

Edge implementations to boost AI

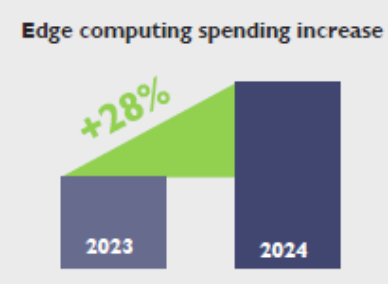

- There is a 28% year-on-year increase in edge investments by CIOs in the ASEAN+ region, with a 25% increase in spending on edge technology across APAC.

- As edge devices produce large volumes of real-time data, they pave the way for new AI model use cases.

- Singaporean CIOs believe that real-time analytics (48%), and retail and customer experience (42%) will see the most significant benefits from AI enhancements through edge computing.

Data, security and skills: The key challenges for AI in 2024

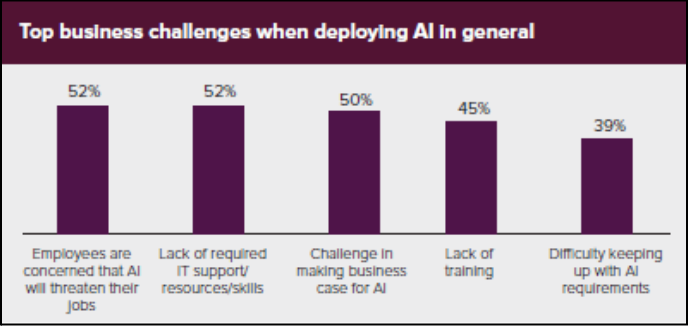

CIOs have identified that a major technological challenge for AI, particularly generative AI, is its dependency on large datasets, which many organisations find themselves lacking. On the business side, concerns about job security and the absence of necessary AI skills are prominent among IT employees in mature markets.

Laurence Liew, Director of AI Innovation in Singapore, emphasised the importance of preparation and skill development for AI projects. “Planning, assessing ROI, and having the required datasets and teams are crucial for AI projects. AI Singapore plays a pivotal role in developing skills through apprenticeship programs and establishing a talent pipeline framework to mitigate the global AI skills shortage.”

Operational AI roles, especially in DataOps, SecOps, and DevOps, remain 75% accessible and relevant, serving as crucial entry points for organisations embarking on their AI journey. However, 45% of APAC enterprises and a higher proportion in the ASEAN+ region (52%) and Singapore (60%) — the highest in APAC — face challenges in recruiting for AI-related positions, often requiring more than double the effort typically needed for hiring. This talent gap is pushing organisations to look inward, highlighting the critical need to upskill existing employees.