Wirecard has entered into a payments partnership with Grab that will see Wirecard process transactions made via the GrabPay e-wallet, starting with the Malaysian, the Philippines and the Singapore markets.

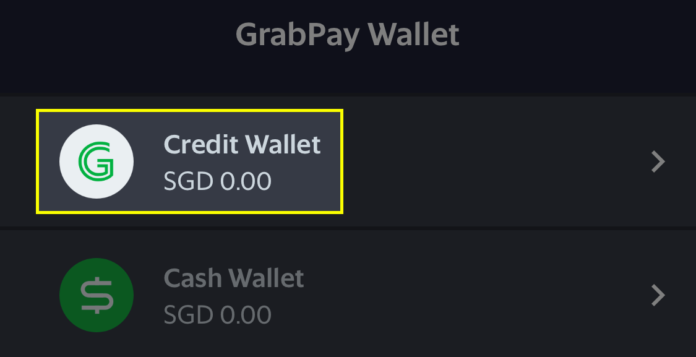

Consumers can use their GrabPay e-wallet to pay for transactions online and offline, for example for ridehailing or food delivery, but can also use it to pay for purchases on e-commerce sites or at physical stores.

Through this partnership, Wirecard will process card transactions for GrabPay via its digital financial commerce platform and will extend GrabPay to more merchants to expand the acceptance of the mobile payment method.

According to a global Wirecard consumer survey, over 90% of consumers in Southeast Asia have used digital payments both in-store and online.

Mobile wallets are almost twice as popular in the region as they are worldwide, with 44% regularly choosing them as a payment method compared to the global average of 25%.

“Together (with Grab), we aim to continue disrupting the payment, tech and mobility industries with innovative solutions that can improve the lives of millions,” said Georg von Waldenfels, EVP for group business development at Wirecard.

Reuben Lai, senior managing director of Grab Financial Group, said Wirecard’s mobile payments solutions will not only complement the GrabPay e-wallet platform, but also offer businesses and consumers the opportunity to transact with greater security, convenience and flexibility.

Over 600,000 merchants and small businesses in Southeast Asia accept the GrabPay e-wallet.