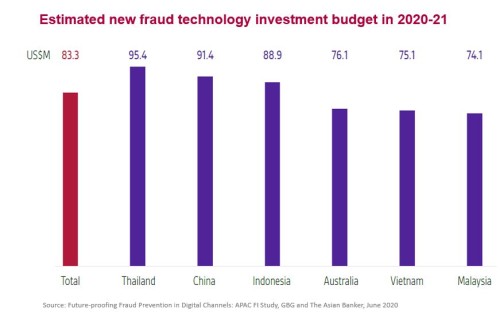

Financial institutions (FIs) in Asia-Pacific countries are projecting an average estimated budget of $83.3 million to purchase new fraud prevention technology in 2020-2021, according to a report from United Kingdom-based GBG.

GBG worked with The Asian Banker to survey 324 financial institutions in Australia, China, Indonesia, Malaysia, Thailand and Vietnam.

The three countries with the highest average estimated fraud budgets are Thailand at $95.4 million, China at $91.4 million and Indonesia at $88.9 million.

The report finds that instant gratification for finance and banking services is seeing greater demand and rollout by financial institutions in APAC, with 31% of FIs planning for instant bank account applications and instant loans, and 29% of FIs planning rollouts of instant credit cards.

Further, financial products like e-wallets are becoming a hygiene factor for 90% of FIs as they look to expand their digital channels and deliver superior customer experiences.

As FIs vie for digital confidence with their target consumers, 66% of respondents cited end to end fraud management platform readiness as a key differentiation to driving preference.

However, only 6% have an existing implementation of an integrated end to end fraud and compliance platform solution, and vertical silos are still seen in 43% of APAC financial institutions and are most prevalent in digital banks.

Upgrading to fraud management platform solutions is also a work in progress for 57% of FIs and almost 50% have planned investment to upgrade their digital onboarding fraud solutions.

The interest in new segments beyond the traditional white- and blue-collared workforce is also apparent. The unbanked segment has pivoted to be a mainstream focus as fraud technology advances, with almost a third of respondents planning to access the unbanked (32%) and underbanked (31%).

”The COVID-19 pandemic will continue to push people and businesses to take digital-first approaches to financial transactions,” said June Lee, APAC managing director of GBG. “From our research, e-wallet, instant financial services, mobile and app banking are going mainstream rapidly, which make it urgent for FIs to take innovative and proactive measures to future-proof against escalating digital financial crimes.”